Middle leaders often operate in a space that feels both rewarding and overwhelming. They support the needs of their teams, absorb expectations from senior leadership, and fill the gaps no one else see...

Manufacturers Face Labor Shortages and a Hardening Insurance Market

The manufacturing industry is currently facing a critical labor shortage. Effects of the COVID-19 pandemic, industry-wide adjustments to the digital revolution, and competition in the labor market from online retailers like Amazon have created a perfect storm—and manufacturers are currently drowning in it.

Effects of COVID-19 Pandemic on Manufacturing Labor Market

Consider the following statistics from Deloitte’s recent industry report:

- Manufacturers say it’s 36% harder to find qualified talent with the right skills than it was in 2018, even though the unemployment rate is much higher today.

- 77% of manufacturing executives surveyed said they expect to have trouble attracting and retaining workers in 2021 and beyond.

- As many as 2.1 million manufacturing jobs will be unfilled through 2030. This will impact manufacturers’ revenue, production, and could ultimately cost the U.S. economy up to $1 trillion by 2030.

In 2019, back before any of us had ever heard the words “COVID-19,” the manufacturing industry was enjoying relatively positive employment numbers. In fact, 2019 marked the fifth consecutive year of employment gains since the bottom of the recession, with the manufacturing industry adding 1.4 million workers in that time period.

Then, of course, COVID-19 hit in March of 2020. Its impact on the manufacturing labor market was severe. The pandemic outbreak initially eliminated around 1.4 million U.S. manufacturing jobs—unraveling nearly a decade’s worth of manufacturing job gains.

Although manufacturers have regained about 69% of the jobs lost during the pandemic, according to the report above, over half a million jobs have not returned. This is despite the fact that unemployment numbers are much higher now than they were before the pandemic.

Difficulties in Filling Entry-Level Manufacturing Positions

Deloitte’s industry analysis of the fastest-growing manufacturing jobs over the next decade reveals that five out of six of these occupations require applicants to have a skill set that spans human and technology aspects, but often does not require formal postsecondary education. The requirements for these positions are relatively basic—following direction, enthusiasm, and punctuality are key. These job openings can typically be filled by recent high school graduates or people transferring from other industries such as hospitality and foodservice.

The manufacturing industry generally provides notably higher starting wages for entry-level jobs than jobs with the same skills required in other industries. In fact, median wages for assembly team workers in the U.S. is $15.55 per hour—over double the federal minimum wage of $7.25 per hour.

Despite this, manufacturers are having major problems filling these positions. This is partly due to competition in the labor market from warehouse and distribution jobs offered by e-commerce companies like Amazon, which offer competitive job rates for entry-level labor.

Difficulties in Finding Skilled Manufacturing Workers

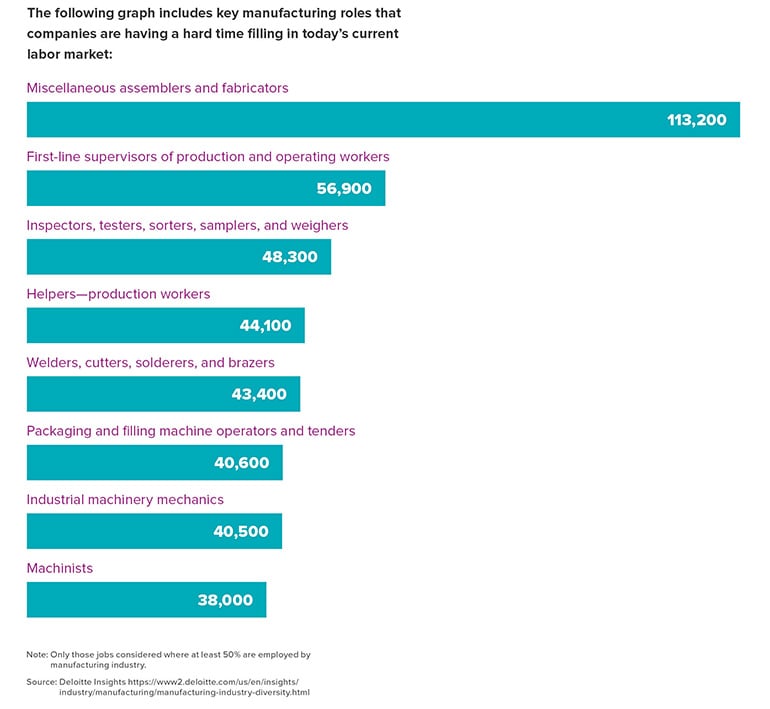

Unfortunately, the manufacturing labor shortage also extends to skilled positions. Skilled manufacturing jobs generally require some level of technical or applied-skills training. These include positions like machinists, welders, electricians, and distribution coordinators.

Finding skilled laborers to fill critical roles is not as simple as filling entry-level manufacturing positions. Most middle-skilled and higher roles require years of experience or hands-on, applied training that can take several months to a year to acquire. Some also require the applicant to be professionally licensed or certified.

Long-Term Impacts of Labor Shortage on Manufacturing Companies

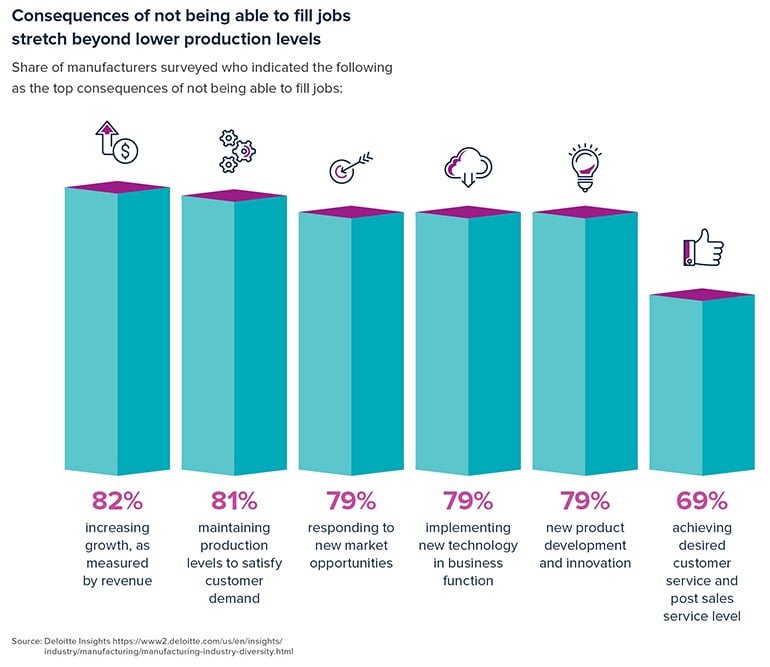

Manufacturers can expect to feel the long-term impacts of leaving job positions vacant and not being able to find skilled workers to respond to market demands in a number of different ways. According to Deloitte, “Almost 80% of manufacturing executives surveyed reported that not filling jobs has a moderate to very high impact on maintaining production levels to satisfy growing customer demand, responding to new market opportunities, supporting new production development and innovation, and even implementing new technologies.”

Ultimately, these factors will create waves that will spill over and potentially affect the overall success and revenue growth of manufacturing companies.

Manufacturers Face Hardening Insurance Market

“Unprecedented” may be the most appropriately over-used word of the past two years. The realities of living through a global pandemic, worsening economic conditions, and an unpredictable future outlook have combined to create unique challenges for business owners across every sector and the insurance industry as a whole. In the past two years, we’ve seen the industry shift out of the longest soft market in recent history and move toward a hard market.

- Soft Market. Also known as a “buyer’s market,” a soft insurance market is associated with stable premiums, expanded terms of coverage, higher available coverage limits, increased market capacity, and a more competitive marketplace among insurance companies competing for new business. A soft insurance market favors the buyer because these conditions make it easier to obtain coverage at a favorable price.

- Hard Market. Also referred to as a “seller’s market,” a hard insurance market is typically characterized by higher premiums, more restrictive terms, decreased capacity and enthusiasm for underwriting, and less competition for new business among insurance companies. A hard insurance market is not as favorable to the buyer because coverage can be more difficult to obtain and prices are not as competitive.

The industry shift toward a hard insurance market is occurring just when risks for manufacturers seem to be higher than ever. Between continued supply chain issues, an industry-wide labor shortage, and an economic downturn, now is the time for manufacturing leaders to take a step back and evaluate the efficacy of their organizations’ risk management efforts.

The importance of working with the right commercial insurance agent cannot be overstated since your insurance coverage protects the livelihood of your business. A professional licensed insurance agent can discuss your current situation, let you know if you have appropriate coverage, and discuss your options.

Related Categories

InsuranceJake Bell, CIC

As Vice President of the Austin Commercial lines market, Jake Bell leads his team to understand the importance of being a valued business resource for his clients and to develop strategies of minimizing risks to better protect their interests. With 14 years of experience in the insurance industry, Jake has always focused on building long-term relationships with business leaders to provide risk management and property & casualty insurance solutions tailored to meet their individual needs.

Let Us Know What You Thought about this Post.

Put your Comment Below.