Middle leaders often operate in a space that feels both rewarding and overwhelming. They support the needs of their teams, absorb expectations from senior leadership, and fill the gaps no one else see...

As a potential recession looms, there’s one important question on Texans’ minds: How will I weather the storm? To help answer that question, we’ll look to the past to see what steps Texas and other states took to rebound from financial hardship and the factors that impacted them. In doing so, we’ll explore three key areas that may determine our economic success in the face of financial turmoil.

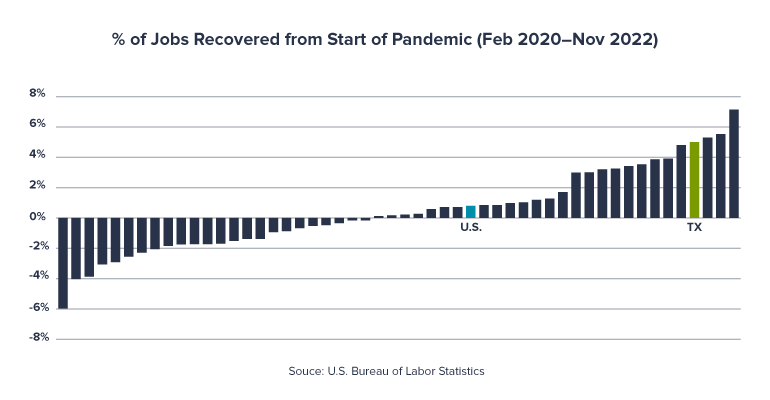

Post-Pandemic Labor Market Recovery

The U.S. economy’s recovery from the pandemic has been uneven across various states. Roughly 40% of states have yet to recover all the jobs they lost between February 2020 and November 2022. Meanwhile, most states have gained back all the jobs they lost, and then some. Texas ranks fourth among those, which is quite high in terms of job recovery.

This unevenness is something to keep in mind as we face a potential recession. Just like the recovery from the pandemic has been uneven, I expect the recession will be also uneven. The states that have recouped their jobs will likely weather the recession much better than the states that have not, and that’s due to a few fundamental reasons:

This unevenness is something to keep in mind as we face a potential recession. Just like the recovery from the pandemic has been uneven, I expect the recession will be also uneven. The states that have recouped their jobs will likely weather the recession much better than the states that have not, and that’s due to a few fundamental reasons:Public Policy

The first reason has to do with public policy. Those states that opened their economies quickly tended to be the states that recovered quickly in terms of jobs. On the other hand, the states that remained tight and took a very conservative approach to opening back up tended to lag other states in terms of job recovery.

Population Migration

Migration is another factor driving these discrepancies between states. Net new migration to Texas accelerated during the pandemic, ranking number two behind Florida.

Over the last 30 to 40 years, we’ve seen an ongoing trend of migration from the Midwest, California, and the Northeast to the more southern and Mountain West states. But an interesting thing happened during the pandemic. That trend actually accelerated—more people moved to the state during that time than in previous years.

In fact, Georgetown, Leander, and New Braunfels were the 1st, 2nd, and 5th fastest growing cities in America by percentage and San Antonio had the largest growth by numerical total population, according to the U.S. Census Bureau.

Part of that is the influence of remote work. Because many Americans can work from anywhere now, why not move to a state like Texas or Florida where there’s no state income tax?

Texas Workforce Age Demographics

The other factor driving regional differences in recovery is the age of states’ respective workforces. Texas is the third-youngest state in the country in terms of its workforce.

States with a younger workforce are recovering more quickly. Why? Their younger workers are coming back to work more quickly. In those states with older workforce populations, we’ve seen a lot of early retirements and those workers have not come back to the workforce, slowing those states’ recovery.

Forecast: The 2023 Economic Outlook for Texas

Texas will likely enter the recession much slower than other states—and might not really feel the worst effects much, if at all.

The Dallas Fed released its forecast for job growth in Texas in February, projecting an increase of 1.4%. To put that into perspective, we’ve been growing by +3% in the years since the pandemic. Over the last 35 years, Texas job growth has typically hovered around 2%. So, while the Fed’s growth projection for Texas is subpar, it’s not negative.

On balance, that’s a positive sign. Again, net migration to our state, the younger populations in our workforce, and our diverse economy will help fortify us against the worst of the storm.

Related Categories

Tax SeasonBlake Hastings

Blake Hastings joined SWBC as Senior Vice President of Corporate Strategy and Chief Economist in July 2021. In this role, he provides leadership in the areas of corporate development and long-term growth strategies. He also supports our business development goals and activities by leveraging external relationships in both the public and private sectors. Additionally, Blake provides direction in the assessment, evaluation, and management of risk throughout the organization. Prior to joining SWBC, Blake worked for the Federal Reserve Bank of Dallas for over 14 years. He served as a Senior Vice President overseeing the San Antonio and El Paso branch offices.

Let Us Know What You Thought about this Post.

Put your Comment Below.