Consumer spending behaviors are continuing to shift in 2025, with more consumers seeking flexible payment options to better manage cash flow amid rising costs and economic uncertainty. Buy Now, Pay La...

The U.S. equity markets remain in a corrective trading range between the January 26th high of 2872 and the rising 200 day moving average of 2588. After an extended period of tranquility following the U.S. Presidential election, volatility has broken out of its own trading range. Beginning with the blowup that led to the closing of several leveraged inverse VIX ETFs, intraday market swings over the last six weeks have been wide and wildly unpredictable (see chart 1). From a technical perspective, the S&P 500 closed the week with a successful retest of the 200 day moving average, providing some hope for the bulls going into the weekend. Last week more than $20.5B flowed out of the IVV and SPY, the two largest domestic exchange traded funds that track the S&P 500. This week it will be important to see if the selling pressure eases, or if this is the beginning of a deeper correction.

There has been no shortage of headlines that have contributed to the selling. The Trump administration continues to turnover his White House staff at an alarming rate. In addition, the announcement of protective tariffs sparked fears of a full scale trade war with the single largest foreign buyer of U.S. Treasuries. This comes at the same time that a $1.3B omnibus spending bill was pushed through Congress and signed by President Trump, which is projected to increase our deficit even further. Facebook, arguably the most widely held stock by institutions and hedge funds, has found itself in the regulatory crosshairs, calling into question the business models of them and other large Silicon Valley companies that are in the business of gathering and selling personal information. Much of this may very well turn out to be “much ado about nothing,” but we are in a market environment where the mantra has become “shoot first, ask questions later.”

While all of this is making the airwaves, there are other factors at play that are not garnering the attention that they deserve. The corporate funding markets are beginning to show some signs of stress. In the short term funding market, LIBOR rates have experienced a rather swift move up across all terms, with the biggest moves in the 3 month and 6 month terms (both up over 60 bps year to date.) The longer term corporate bond market has also seen spreads widen, as the difference in yield between a 5 year treasury and a Baa rated corporate bond is wider by approximately 33 bps since hitting a low spread of 176 bps on January 31st. All of this is occurring against the backdrop of normalization by the U.S. Fed, where the data continues to support multiple rate increases this year.

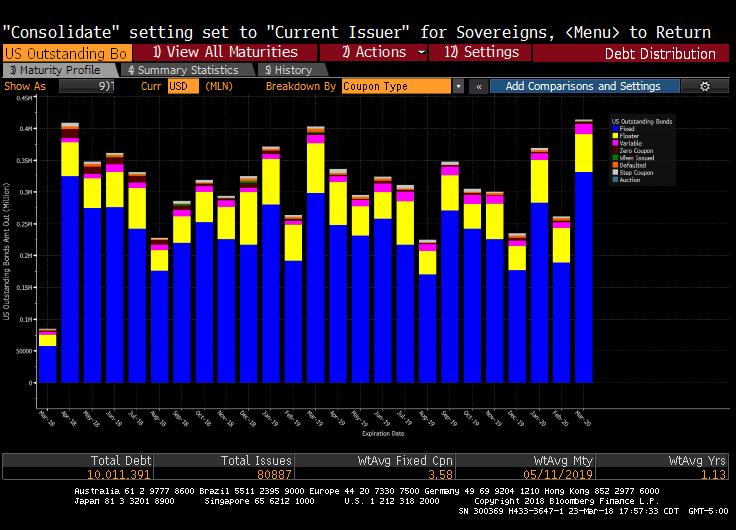

What this means for the market is that the cost of capital (discount rates) is increasing and being priced into risk assets. The cost of debt capital is rising as benchmark interest rates increase and the business cycle matures. Higher risk-free rates and increased volatility equate to a higher cost of equity capital. All of these factors need to be adjusted in valuation models, and can have a tremendous effect on the intrinsic value of risk assets. In addition, there is an enormous amount of corporate debt maturing over the next few years. The chart below shows that over $10T (yes, trillion with a T) of USD denominated corporate bonds are set to mature over the next two years with a weighted average coupon of 3.58%. This becomes problematic for companies that have relied heavily on debt financing and levered up their balance sheets to take advantage of low rates with little to no covenants. Repatriation will help some multinational companies navigate this with relative ease, but many are going to find themselves forced to pay a higher rate to roll it, or default and proceed with workout. The latter is not good for the holders of the debt.

None of this is intended to suggest that the equity markets can’t go higher. I believe that it should and will for the right reasons, just not all together in sync. Earnings growth is accelerating, the employment picture remains in good shape, and the regulatory environment has become much more “business friendly.” All of these factors should contribute to higher stock markets around the world. However, I do think there will be more of a bifurcated market, where good management teams and good stewards of capital will be rewarded with higher stock prices, and self-serving management teams and terrible stewards of capital will go the way of GE.

Member SIPC & FINRA. Advisory services offered through SWBC Investment Company, a Registered Investment Advisor.

Not for redistribution—SWBC may from time to time publish content in this blog and/or on this site that has been created by affiliated or unaffiliated contributors. These contributors may include SWBC employees, other financial advisors, third-party authors who are paid a fee by SWBC, or other parties. The content of such posts does not necessarily represent the actual views or opinions of SWBC or any of its officers, directors, or employees. The opinions expressed by guest bloggers and/or blog interviewees are strictly their own and do not necessarily represent those of SWBC. The information provided on this site is for general information only, and SWBC cannot and does not guarantee the accuracy, validity, timeliness or completeness of any information contained on this site. None of the information on this site, nor any opinion contained in any blog post or other content on this site, constitutes a solicitation or offer by SWBC or its affiliates to buy or sell any securities, futures, options or other financial instruments. Nothing on this site constitutes any investment advice or service. Financial advisory services are provided only to investors who become SWBC clients.

Related Categories

Capital MarketsJosh Lynch

Josh Lynch assumed the position of Director of Portfolio Management of SWBC Investment Services, LLC in 2014. He is responsible for managing all of the firm’s proprietary portfolios. He began his career in risk management with a Fortune 500 company. After 11 years, Josh transitioned to financial services joining Merrill Lynch in 2009. He joined SWBC Investment Services in 2011 as an Investment Associate, where his focus was on portfolio strategy and analysis. He also partnered with the Wealth Management team in providing customized portfolio solutions to corporations, defined benefits plans, non-profit organizations, and high net worth individuals. Josh is a graduate of Florida State University with a Bachelor of Arts in History and Economics. He earned the Chartered Financial Analyst (CFA®) designation and holds FINRA Series 7 and 66 licenses.

Let Us Know What You Thought about this Post.

Put your Comment Below.