Consumer spending behaviors are continuing to shift in 2025, with more consumers seeking flexible payment options to better manage cash flow amid rising costs and economic uncertainty. Buy Now, Pay La...

Like most markets these days, the mortgage industry is facing considerable economic headwinds as high inflation and the threat of a recession make it difficult to pin down—let alone lower—mortgage rates. According to a recent Bankrate survey, the benchmark 30-year-fixed-rate mortgage averaged 5.38% last year and has been at or near 7% since Q2 2023.

Affordability, Foreclosure Impacting Some Borrowers

Prospective homeowners are standing on the edge of a growing affordability gap. It currently requires 33.2% of the national median household income to afford the median-priced home, well above the long-run average of 25%.

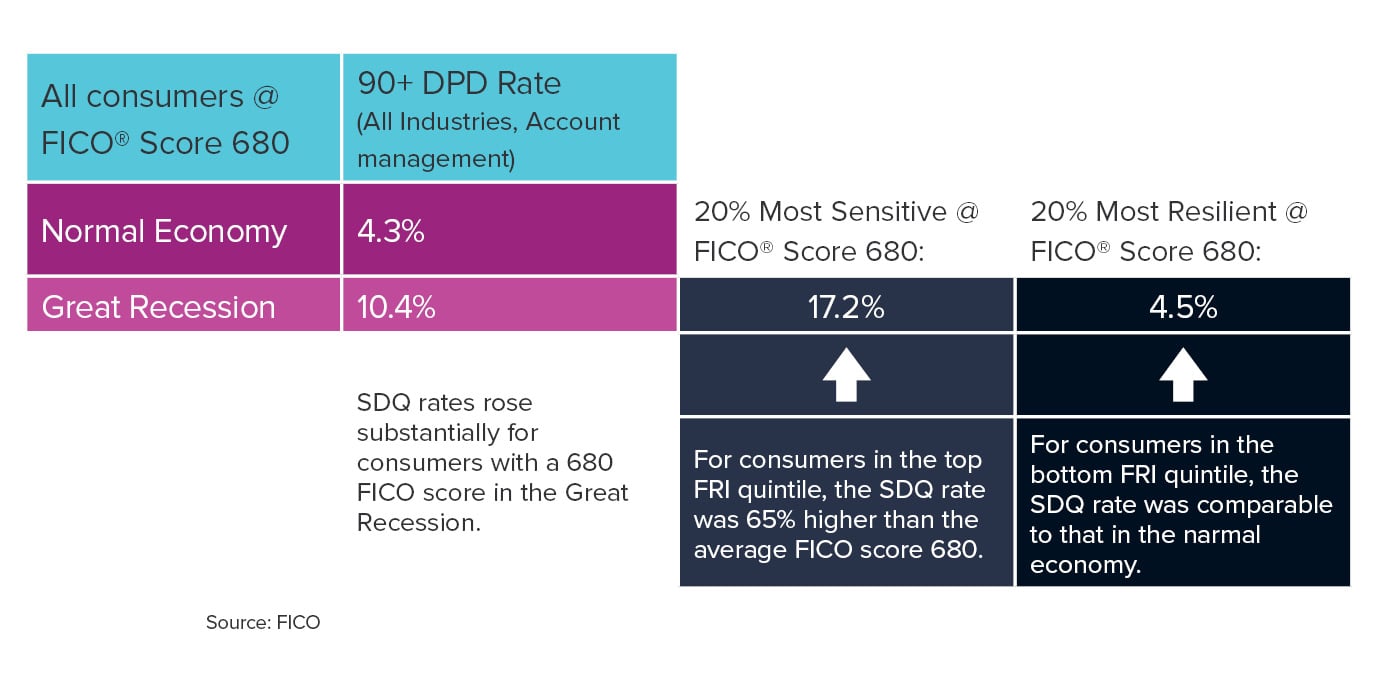

As the growing affordability gap dampens new home sales, current homeowners are also beginning to struggle against foreclosure. The FICO Resilience Index (FRI) predicts how resilient a borrower’s credit may be in the face of economic disaster, like a recession or market downturn. Consumers with an average 680 FICO score with less resilience (high FRI) are experiencing a greater rate of serious delinquency (SDQ) than more resilient (low FRI) consumers with the same FICO.

Best Practices for Leveraging LPI

Amidst the market’s turbulent conditions, lender-placed insurance (LPI) has emerged as an essential tool for mortgage lenders and servicers to mitigate risk associated with default, foreclosure, or other adverse events.

LPI is an insurance policy purchased by lenders to protect their investments in the event a borrower’s own insurance coverage lapses or is deemed inadequate. It also helps lenders remain compliant with federal and state regulations and investor guidelines, which often require properties securing mortgage loans to be adequately insured against potential hazards.

Here, we examine six best practices for leveraging LPI as a successful risk mitigation program that demonstrates your commitment to protecting investments and meeting regulatory obligations:

1. Establish Clear Policies and Procedures

Mortgage lenders and servicers should develop a comprehensive LPI program that outlines the criteria for placing insurance, the process for notifying borrowers, and the steps for monitoring and maintaining coverage. These policies and procedures must be consistent with regulatory requirements, investor guidelines, and industry best practices.

2. Educate Borrowers About the Importance of Insurance

Borrowers need to know how vital it is to maintain adequate insurance coverage and the potential consequences of lapses or insufficient coverage. Proactively communicate its importance to them, offer resources and support to help them understand their insurance requirements and options, and work with them to address any coverage gaps or issues.

3. Continuously Monitor Insurance Coverage

A robust system for monitoring borrowers' insurance coverage helps identify potential lapses or inadequacies. Leverage technology and data analytics to streamline this process and ensure timely and accurate tracking of insurance information.

4. Foster a Culture of Compliance and Risk Management

Within your organization, encourage a culture that values risk management and compliance as essential components of long-term success. Provide ongoing training and support to employees to help them understand the importance of LPI and their role in implementing and maintaining the program.

5. Review and Update Your LPI Program Regularly

The effectiveness of your LPI program relies on routine assessment and adjustment as needed to address emerging risks, regulatory changes, or shifting market conditions. Engage in continuous improvement efforts to ensure that your LPI program remains a valuable risk management tool for your mortgage servicing operation.

6. Partner with a Reputable LPI Provider

An LPI provider with a proven track record of delivering high-quality coverage and exceptional customer service can elevate a mortgage lender’s risk mitigation efforts. Look for a provider that offers tailored solutions to meet the unique needs of your credit union or mortgage servicing operation, as well as robust reporting and analytics capabilities to support ongoing risk management efforts.

A quality LPI program not only protects mortgage lenders, but also serves as a valuable customer service tool for borrowers who are struggling. By adopting these best practices, you can better help borrowers sidestep costly penalties and potential legal issues while protecting your assets.

Related Categories

LendingKathy Iseley

Kathy Iseley serves as Senior Vice President of Sales for SWBC's Financial Institution Group and is based in Dallas, Texas. Kathy’s main focus is working with mortgage servicers and the large bank market nationwide, providing risked-based insurance solutions for mortgage and REO portfolios. Kathy has been a veteran of the mortgage banking industry for over 30 years. Her experience ranges from directing large mortgage divisions to developing growing companies into industry leaders.

Let Us Know What You Thought about this Post.

Put your Comment Below.