Consumer spending behaviors are continuing to shift in 2025, with more consumers seeking flexible payment options to better manage cash flow amid rising costs and economic uncertainty. Buy Now, Pay La...

Everything happening in our economy today hinges on inflation. If inflation continues to fall quickly, robustly, and smoothly, we can expect the U.S. economy to rebound well. Consider it a softish landing, as the Fed continues to work on lowering inflation rates by raising interest rates. But if inflation refuses to come down as quickly as economists would like, that may put pressure on the Fed to continue raising rates—and keep them elevated longer. This would mean a slower economy ahead.

In this blog post, we’ll examine the current economic landscape, explore how it affects borrowers, and see what it means for lender mortgage portfolios.

Inflation Is Trending Downward

Recent inflation readings have been moving in the right direction. There has been a downward trend from the 9.1% peak in June 2022 to 4.9% in April. While it is a significant drawdown, it stems primarily from “simple” economic fixes: commodity prices and other things that are easier and typically faster to react when monetary conditions tighten. However, progress has slowed considerably when we examine the core measures the government is taking to hinder inflation. We are now working from a position where reaching the 2% mark will be a slow grind.

.jpg?width=1389&height=740&name=inflations-impact-on-the-housing-market-mortgage-maze-graph-4%20(1).jpg) Rents May Continue to Rise

Rents May Continue to Rise

In typical cycles, rents and owner equivalent rents (approximately 40% of overall inflation) tend to peak 12-18 months after house prices peak. We do not expect to see improvement in this part of the inflation picture until the middle of this year, as recent inflation data suggests it is beginning to moderate.

U.S. Labor Market and Wages Add Complexity

Wages may be more difficult to lower, as recent data shows the ratio of available jobs to people who are unemployed is 1.7. That means there are almost two jobs available for every unemployed person in the country. When the labor market is not in equilibrium, wages will continue to be pressured upward.

The labor market will likely be the toughest part of the inflation calculus to lower. The economy needs to see wages growing roughly 3% each year for overall inflation to hit the 2% target. More than 236,000 new jobs were created in March, which means the jobs market is still strong, though cooler than the 472,000 and 360,000 jobs created in January and February, respectively. At some point, job demand needs to cool further to restore balance to the labor market.

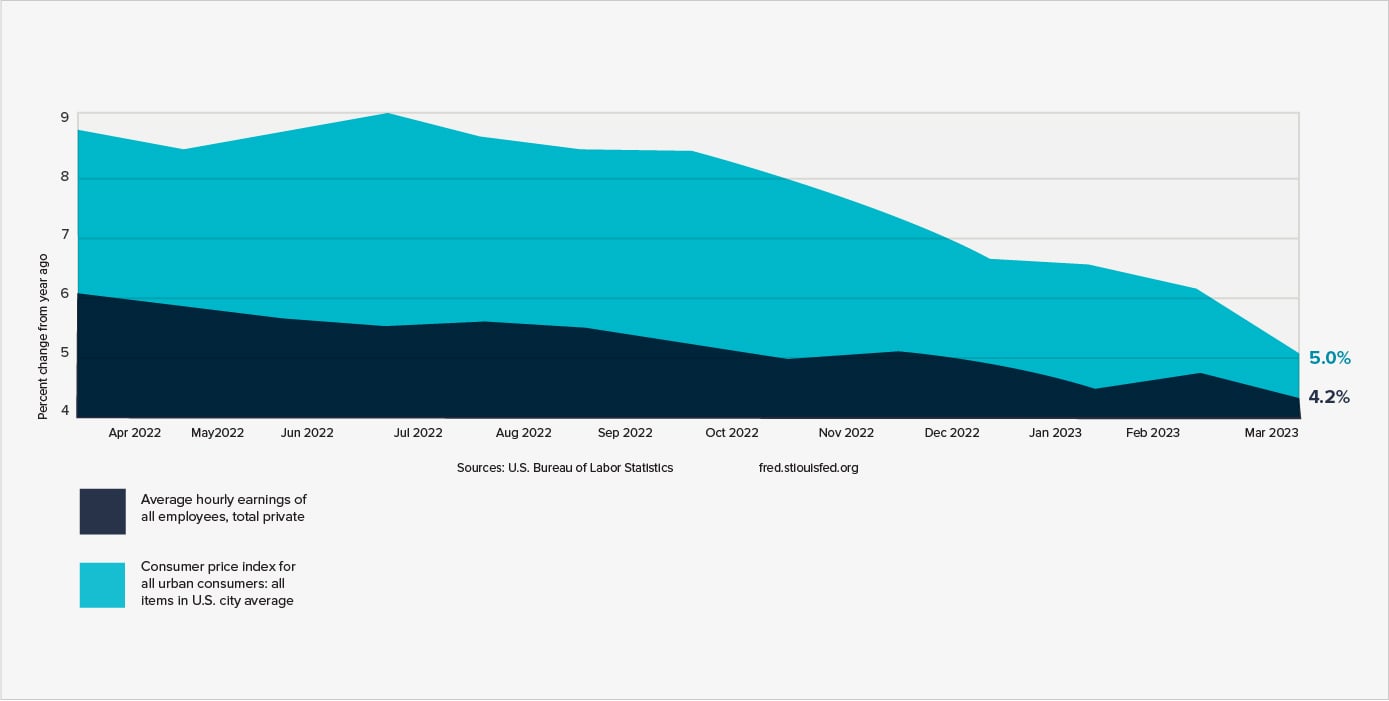

Consumer Buying Power Continues to Lag

Although there has been positive wage growth, wages are still not keeping up with inflation. The good news? The gap between wage increases and inflation is cooling. According to the U.S. Bureau of Labor Statistics, consumers’ wages are going up roughly 4.2%, meaning consumers are falling behind by a little less than 1% regarding purchasing power.

Many economists call this real income. Since consumer real income is still in negative territory, it will continue driving the economy into a slowdown, which the Fed is working hard to prevent. As long as consumers have negative real wages, it will be impossible to have sustainable growth in our economy.

Borrower Finances May Soon Be Maxed

Credit cards and home equity loans have helped borrowers prop up their spending, but that is reaching its natural limit. We expect spending to continue its drift into the red. Considering consumer spending is roughly two-thirds of the U.S. economy, a weakening outlook for consumption is not a good sign. Credit and auto delinquencies may continue to rise as savings are depleted and more borrowers struggle against inflation.

Looking Ahead: The U.S. Economy

Continued inflationary pressures (especially from housing and wages) are creating tighter credit conditions across all forms of lending. Combined with negative real income growth, decreased savings, and a worsening outlook for consumer spending, we continue to predict a recession beginning in Q3 this year.

Our Fed Policy Outlook

- 25-5.5% terminal rate expected this year

- Lower rates in early 2024

- Fed may signal the market in late 2023, especially in the event of a recession

Our Market Rates Outlook

- Market rates for mortgages, commercial, and corporate bonds will peak during the Fed’s “pause”

- Rates may drift down toward the end of the year in anticipation of the Fed lowering them

- Market rates may take years to reach pre-pandemic levels, if ever

Economic challenges and their implications for the mortgage market highlight the fact that financial institutions must be prepared to mitigate risks associated with their lending portfolios. Lender-placed insurance (LPI) will play a critical role in protecting financial institutions’ investments by ensuring adequate insurance coverage for mortgaged properties.

LPI programs provide a safety net for lenders when borrowers fail to maintain sufficient coverage or when there is a lapse in their insurance. SWBC offers customizable LPI programs to meet the unique needs of financial institutions in our current economic climate. With a focus on compliance, scalability, and borrower convenience, we provide multiple options for managing and monitoring mortgage portfolios.

Related Categories

LendingBlake Hastings

Blake Hastings joined SWBC as Senior Vice President of Corporate Strategy and Chief Economist in July 2021. In this role, he provides leadership in the areas of corporate development and long-term growth strategies. He also supports our business development goals and activities by leveraging external relationships in both the public and private sectors. Additionally, Blake provides direction in the assessment, evaluation, and management of risk throughout the organization. Prior to joining SWBC, Blake worked for the Federal Reserve Bank of Dallas for over 14 years. He served as a Senior Vice President overseeing the San Antonio and El Paso branch offices.

Let Us Know What You Thought about this Post.

Put your Comment Below.