Consumer spending behaviors are continuing to shift in 2025, with more consumers seeking flexible payment options to better manage cash flow amid rising costs and economic uncertainty. Buy Now, Pay La...

Digital Payments Solutions to Delight Your Indirect Borrowers

Table of Contents

The Benefits of Serving Indirect Borrowers with Convenient Payment Options

UX Design Strategies to Create a Seamless Payments Experience for Indirect Borrowers

How Much Profit Are You Missing from Your Indirect Borrowers?

Introduction

Indirect lending is a large part of many financial institutions' auto lending strategies. In fact, in 2020, credit unions held $378.2 billion in auto loan balances, or roughly 31.5% of all auto loans in America. Of that, 84.4%, or $319.4 billion, was funded through indirect channels.

If indirect borrowers make up such a large percentage of your institution’s auto lending portfolio, and you’re not focusing your efforts on engaging and serving this population, you could be missing out on a huge opportunity to build a relationship with your indirect borrowers. Effectively engaging with indirect borrowers offers a unique opportunity to change their experience of your institution from a generic finance company that holds their auto loan to being an active participant in their financial lives. To accomplish this, you’ll need two critical tools:

- Convenient and secure payment options that will provide a seamless user experience for your indirect borrowers, making them more likely to make loan payments promptly and avoid payment default. It can also help your institution increase profitability by creating potential future revenue streams while saving you time, money, and exposure to risk.

- An intuitively designed and easily navigable digital payments system that will delight your indirect borrowers. These borrowers have likely never been exposed to your institution’s ecosystem, so creating a seamless digital payments experience will give you the opportunity to impress these borrowers with the intuitive feel, easy navigation, and pleasing aesthetic of your online environment. This, in turn, will make your indirect borrowers more likely to want to work with your institution when you introduce them to more of your products and services.

In this article, we’ll discuss the benefits of serving your indirect borrowers with convenient payment options, outline UX design strategies that will help ensure your borrowers have an optimal experience in your digital environment, and give you tips for increasing the profitability of your indirect lending portfolio.

The Benefits of Serving Indirect Borrowers with Convenient Payment Options

With indirect lending programs, not only do you benefit by gaining a new auto loan for your portfolio, but you also have the opportunity to deepen the relationship with those new borrowers by providing convenient payment solutions. Indirect borrowers have the largest need for a convenient method to make a payment on their auto loan—after all, this is currently the only relationship they have with you—and if your online banking solution is only available to current customers with checking and savings accounts, you're leaving your indirect borrowers at a major disadvantage.

Digital payments—those transacted online or at a store’s POS—are estimated to increase >20% globally in 2021, reaching $6.7 trillion.

It's fair to say that growing your relationship with indirect borrowers may be challenging. Marketing to this population can be expensive and might convert minimal ROI. However, engaging with these borrowers through your institution’s payments channel is an inexpensive strategy that can get your borrowers engaged with your institution on a monthly basis.

We talk often about the importance of providing borrowers with convenient and secure payment options because we realize that falling behind the technology curve when it comes to banking options can cause borrowers to take their business elsewhere.

More than 75% of all U.S. consumers made some kind of mobile transaction–such as an online payment, an in-app payment, or an in-store mobile payment–in a 12-month period ending in August 2019.

Did you know that the pandemic has accelerated the adoption of digital products and/or services by six years? This means, if your organization was planning to expand its digital payment options to your account holders in the next one to six years, you are now even further behind the curve. In the post-pandemic environment of low auto interest rates and strong competition, lenders can't afford to lose existing borrowers.

There are several benefits to offering an online payment solution to your indirect borrowers:

1. Convenient payment options can help offset indirect borrower default.

Your borrowers are busy. Requiring them to take time out of their schedule to call or write and mail a check just to make their loan payment is tedious and inconvenient. Most borrowers prefer to simply log in to an online payment portal from the convenience of their computer or smartphone to quickly and securely make their loan payments, rather than having to take time out of their day to call or drive to the nearest branch.

A large majority of consumers expect to have multiple options when it comes to paying bills. Significant majorities of millennial and Gen Z consumers report debit cards (94%), mobile wallets (82%), and digital payment apps (83%) are a "must-have" or "nice to have."

When your borrowers have a convenient payment platform that is available 24/7 with multiple payment options (credit or debit card, checking or savings account, ACH payments), they are less likely to experience delinquency issues due to lack of convenience. When your collections team does not have to spend time and resources contacting borrowers that are late on their payments (simply because they haven't had time to make a payment), it allows them to focus on borrowers that are truly delinquent and in need of a mutually beneficial solution.

2. Self-serve payments allow you to meet borrower expectations while freeing up internal resources.

Only accepting phone payments from your indirect borrowers requires substantial customer service resources. In most cases, your employees wear multiple hats, and the time spent on the phone taking a loan payment could be spent elsewhere, on more productive tasks.

More than 60% of U.S. consumers say their go-to channel for simple inquiries is a digital self-serve tool such as a website (24%), mobile app (14%), voice response system (13%), or online chat (12%). But, as the complexity of the issue increases, such as with payment disputes or complaints, customers are more likely to seek out a face-to-face interaction (23%) or a real person on the phone (40%).

Giving borrowers the capability to self-serve can result in major cost savings for your institution. Rather than adding multiple employees to your staff to take phone payments, paying their wages and employee-related expenses, and training them, just making the initial investment in an online and mobile payment solution can be much more cost-effective in the long run.

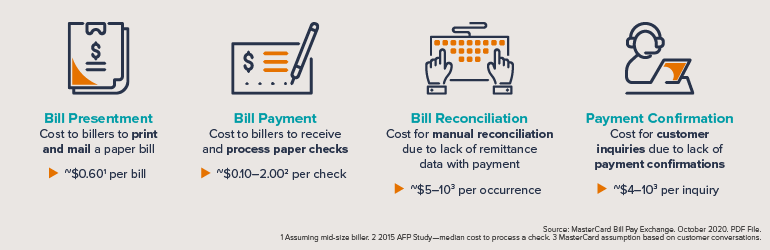

Consider the following data from MasterCard about the cost of antiquated payment methods for your institution:

Reaching out to your indirect borrowers before their payment is due to introduce them to and enroll them in your self-serve payments system early on will also help ensure prompt payment and offset potential default.

3. Impressing indirect borrowers with convenient payments could open the door to future revenue streams.

Offering indirect borrowers convenient, easy-to-access payment options is a great way to build a positive user experience with a consumer who doesn't have an existing relationship with you. More likely than not, your indirect borrower is only working with your institution because of your competitive auto loan rate, and likely doesn’t know anything at all about your other products and services. This means, making their loan payment is likely the initial point of interaction your indirect borrowers will have with your institution.

Ensuring access to convenient payment options will provide a seamless user experience for this interaction, which gives you the opportunity to make a positive first impression with your indirect borrower, potentially turning them into a multi-product member. If you build upon a strong foundation, you could easily cross-sell multiple products and services, including:

- Checking and savings accounts

- Credit cards

- Home loans

- Auto insurance

- Life and payment protection insurance

- Vehicle warranty and loan products (GAP, MMP, etc.)

Additionally, there is an added benefit to the borrower when they make payments directly to your financial institution. Typically, payments made directly to your institution will be posted to the borrower’s account on the same day, whereas, if they schedule payment from their home-banking account, it could take a couple of days for credits to be posted.

4. Digital payments offer added layers of security for you and your indirect borrowers.

The problem with some of the "old school" ways of making payments, such as mailing a check or making a payment over the phone, is the increased risk of human error. Mail gets lost, employees make mistakes, and, though unintentional, it exposes you and your borrowers to risk.

Did you know? Online transactions from any reputable vendor are also protected by SSL certificates (to protect data in transit), firewalls, and regular systems scans.

However, many online solutions provide added security, both for you and your borrowers. For example, with an online payment solution that includes multi-factor authentication, borrowers are required to verify their identity using multiple methods, such as text or email confirmations. This helps minimize fraudulent activity, giving your borrowers—and your institution—an added layer of security.

As you can see, the disadvantages of not providing indirect borrowers with a convenient and viable payment solution can be impactful; likewise, the advantages of providing a solution can lead to strong relationships with new borrowers and multiple potential income streams.

UX Design Strategies to Create a Seamless Payments Experience for Indirect Borrowers

With the explosive rise in mobile apps and other smartphone technology over the past decade, UX design has become a critical tool in ensuring your borrowers can easily access, navigate, and enjoy your institution’s online ecosystem. UX design seeks to optimize the interactions between real human users and the products and services they use every day. This can include anything from buying snacks out of a vending machine to assembling IKEA furniture, but the term is most often applied to websites, apps, and, for financial institutions, online payment portals.

Investing in UX during a project’s concept phase reduces product development cycles by 33-50%.

UX design encompasses far more than the aesthetics of a digital banking product. It’s about creating an experience that delights the end-user of that product. If your indirect borrower logs on to make their auto loan payment, the sign-in process is a breeze, the layout of your site is pleasing, they’re able to make their payment, and a payment confirmation immediately appears on their phone or inbox, they’re going to leave with a positive impression of your institution. This means, when you engage these borrowers to offer further products and services, they’ll be more likely to respond favorably to your brand.

On the other hand, not having an intuitively designed payments system can be a major roadblock for your institution. If your borrower logs onto your website or payment portal, can’t find where to log in, has a hard time navigating your platform, gets bombarded by irrelevant pop-ups, and has a payment confirmation that arrives an hour late, they’re going to feel frustrated—and this feeling will direct their overall opinion of your institution.

A single bad experience on a website makes users 88% less likely to visit the website again, and 70% of customers abandon purchases because of a bad user experience.

Creating a seamless payments experience is particularly important for your indirect borrowers, whose only interactions with your institution often occur in your digital environment. You want them to be so impressed with the intuitive feel, easy navigation, and pleasing aesthetic of your online ecosystem that they will be interested in exploring your environment further when you engage them to offer other products and services.

Here are some helpful UX strategies you can employ to help ensure your institution’s payment system delights your borrowers:

1. Strive for Simplicity

An overcrowded website that is cumbersome to navigate will overwhelm your user, which leads to frustration. This negative user experience often translates to feelings of frustration with your entire institution on the part of your borrowers. Don’t pack your website or online portal with too many graphic or text elements. The barrage of colors and conflicting shapes will create a feeling of chaos and anxiety for your user. Instead, stick to a coherent aesthetic that supports your brand. When your user navigates from page to page on your site, you want them to have a sense of continuity.

2. Appealing Aesthetic and Intuitive Design Matter

When designing page elements, stick to a color palette that is inviting—abrasive flashes of neon color might get your users’ attention, but it will probably stress them out. You want to make sure your site has plenty of white space for your user’s eye to settle on between relevant information. Use consistent fonts, and make sure other elements such as buttons and icons support the intuitive navigation of your site.

3. Walk Your Borrowers Through Site-Navigation

When a borrower walks into a physical branch, there are signs for them to follow. There are clearly marked lines to stand in, and if a person looks lost, there are plenty of employees there to help direct them to the right place. Borrowers who only interact with your institution online don’t have those elements to help direct their experience.

You don’t want your indirect borrowers to get lost when they’re trying to make a payment. Spend some time educating your borrowers about how to navigate your site. You could post tutorials, video walkthroughs, or infographics to help guide them through the process. You’ll also want to include easily accessible FAQs and help sections on your website to help your borrowers troubleshoot common problems.

4. Be Transparent

When it comes to making a loan payment, your borrowers don’t want any surprises. You’ll want to be transparent about transfer times and fees, and set clear expectations for how much time your borrower will need to spend to complete a transaction. If your site is experiencing a problem, make sure your borrowers are informed about any delays or wait times. The last thing you want is for your borrower to panic when trying to make a loan payment. Provide reassuring messaging that explains the situation and details next steps for them to follow.

5. Make Your Digital Environment Accessible to All Users

Web accessibility is meant to ensure that websites, online tools, apps, and other digital technology are designed so that people with disabilities can use them. The Americans with Disabilities Act (ADA) covers rules governing the accessibility of government websites. While there are no regulations currently governing the private sector, the Department of Justice is considering issuing similar regulations for private-sector websites.

“While there is no formal federal prescription on exactly what you need to do, the best practice is to make your website conform to WCAG 2.1 AA. AA refers to the conformance level that is most commonly required and accepted, not only in the United States but across the globe. WCAG 2.1 AA basically amounts to 50 things you can do to improve the accessibility of your website, or mobile app.” -Essential Accessibility

6. Adopt a Mobile-First Mindset

We are an increasingly mobile-first society. Given the fact that Americans spend an average of 2 hours and 55 minutes on their smartphones every day, it’s fair to say that keeping mobile accessibility top-of-mind when designing your payment system is important.

80% of users abandon a mobile site if they have a bad user experience, and mobile users are 5X more likely to abandon a task if the site isn’t optimized for mobile.

Optimizing your digital environment for mobile users is not as straightforward as reducing the screen size to fit a smaller window. Other constraints that impact mobile UX design include screen size, storage constraints, on-screen controls and navigation, operating from a single window, and even how people hold their phones.

Here are some additional UX design strategies for optimizing your mobile experience from UX design expert, Shane Ketterman:

- Design for every user and every type and size of a mobile device

- Design for all the various ways people work with their devices

- Consider that users prefer to touch the center of their screen in most cases

- Place key actions in the middle half to two-thirds of the screen

- Make sure fingers and thumbs don’t obscure content

- Selectable items should be large enough to be tapped on comfortably

The digital-payments paradigm shift has already occurred, and financial institutions will need to delight their borrowers with impeccable online experiences to keep pace.

How Much Profit Are You Missing Out On from Your Indirect Borrowers?

Let’s say your indirect lending team funds a $30,000 auto loan. Your costs for the fee paid to the dealership and other expenses of running your indirect program add up to 3%, or $900. If you finance this loan for 72 months at 2.99%, with a net interest spread (interest earned less interest expenses and loan loss provision) of about 75%, this indirect loan will generate about $625 dollars in interest in the first year for your institution. With the dealership fee and indirect expenses factored in, that means your credit union is still $275 away from making a profit.

Now let’s say that you incorporated strategies from this whitepaper to effectively engage your indirect borrowers. SWBC's Digital Customer Experience (DiCE) online application allows your members to purchase Major Mechanical Protection (MMP) through a simple quoting and application process embedded on a website page of your choosing and accessed via desktop, tablet, or smartphone device. Effectively cross-selling this product to your indirect borrowers could net your institution $300.

You could also encourage your indirect borrower to sign up for recurring payments through SWBC’s BACON Loan Pay. This borrower-facing portal provides a variety of easily accessible channels for your indirect borrowers to make their loan payments. Your institution will be able to set and charge a convenience fee for payment processing, increasing your profit.

You can also view increasing profits from your indirect lending portfolio in terms of dollars saved. According to data from MasterCard, the average cost of tending to customer inquiries that stem from lack of payment confirmations is $6 per inquiry. SWBC’s Payments program automatically sends payment confirmations to your indirect borrowers via text or email, which helps minimize the need for such inquiries and saves your institution money.

Conclusion

Chances are, not all of your indirect borrowers are going to open checking and savings accounts with your institution, but that doesn’t mean you should overlook this population. Taking the time to build a relationship with these borrowers by offering peerless service and convenient payment options will help make your indirect lending portfolio more profitable.

It’s important to see every indirect loan your institution funds as an opportunity to capture additional business. Establishing a personal connection through engaging communication strategies will help you transform your indirect borrowers into consumers who have a connection to your institution. Over time, you’ll have more opportunities to deepen that connection with your borrowers by offering other useful products and services, which in turn, helps increase your profit.

Let Us Know What You Thought about this Post.

Put your Comment Below.