Consumer spending behaviors are continuing to shift in 2025, with more consumers seeking flexible payment options to better manage cash flow amid rising costs and economic uncertainty. Buy Now, Pay La...

In our modern, digital world, the financial landscape is evolving—and fast. Today’s money moves at the speed of the Internet, which means banking isn’t what it used to be.

As change sweeps through the banking sector, traditional banks—especially smaller financial institutions like community and regional banks—must understand why embracing the technology that’s reshaping the industry isn’t simply an option, it’s a necessity.

In this blog post, we’ll explore compelling trends in digital banking and see why it’s crucial for all banks to keep up.

The Digital Banking Revolution

While the definition of digital banking can vary, it’s essentially composed of two tech-forward concepts: online banking and mobile banking.

Online banking refers to completing certain tasks via your bank’s website from a computer. This could include checking balances, paying bills, or applying for financial products like loans or credit cards. Account holders can perform these actions securely and conveniently through a banking portal that requires their credentials to log in.

Like online banking, mobile banking gives account holders the ability to do many of those same functions on the go, through a proprietary banking app accessed from a smartphone or tablet. The apps are also accessed using the account holder’s credentials.

Not all financial institutions that engage in digital banking are digital-only, but many of them have adopted an online-only model. According to McKinsey & Company, roughly 200 digital banks have launched since 2015, and they’re reimagining what customers have come to expect of financial services now and in the future. A recent report from Bankrate estimates that 60% of consumers have expressed interest in using a digital bank in the next year, while another 27% revealed they currently use an online-only bank.

The Path Forward for Traditional Banks

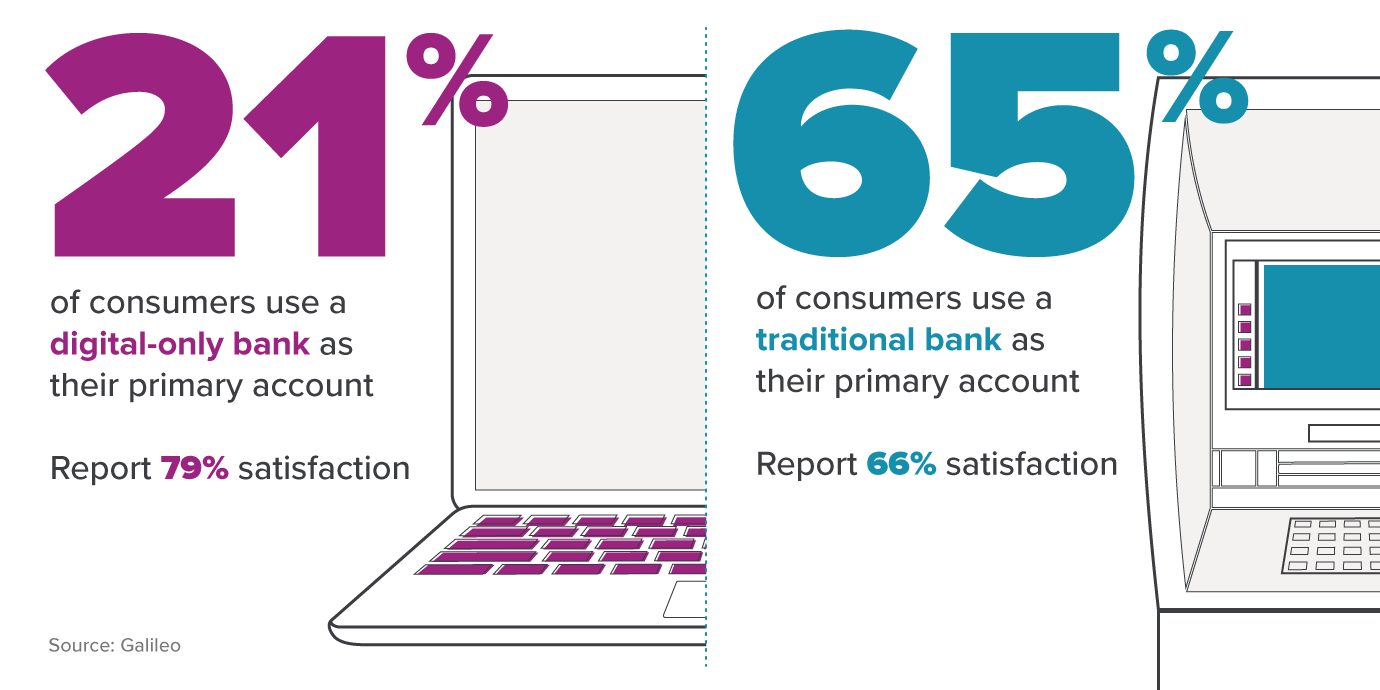

According to fintech Galileo, 65% of consumers still use traditional banks for their primary accounts. Perhaps the fly-by-night feel of digital banks with limited history and lack of physical presence has consumers cautious about fully committing, especially in the wake of recent bank failures.

Still, the allure of modern conveniences is enough to give tradition a run for its money. Brick-and-mortars can’t rely solely on their reputation without meeting their account holders’ digital banking needs if they want to stay relevant in a fast-paced financial environment. Here are some ways traditional banks can seize the moment.

Put Banking at Their Fingertips

Digital banking doesn’t close for the day. It’s available 24/7, 365 days a year. If account holders must navigate business hours to visit a branch for critical banking needs, they may opt for more convenient alternatives.

And those conveniences shouldn’t end at basic banking needs like opening a checking or savings account either. These days, it’s standard to apply for a credit card and home or auto loans electronically and receive pre-authorization in moments. Be sure your account members have access to many of your products and services from wherever they are at whatever times they need them the most.

Protect Your Customers

Security is paramount in a digital age. Account holders trust banks with sensitive financial information and it’s up to those institutions to protect it. Investing in cybersecurity measures instills confidence in customers that they can share vital information safely and securely whether they’re in your branch or not.

Technology also offers advanced security options, like biometric authentication for logging into apps and AI-powered fraud detection that triggers customer alerts. Blockchain technology, a complex method of recording information, can help thwart would-be hackers, keeping both your account holders and your bank free from financial harm.

Stay Human

Although tech plays a significant role in modern banking, it’s important to maintain a human touch. Community and regional banks can offer the best of both worlds by using technology to streamline staff- and member-facing processes while maintaining the personal service their account holders have come to expect.

To this end, think of technology simply as an extension of that personal service, allowing you to tailor your products to individual account holder’s needs. In today’s world, personalization is the key to winning and retaining customers, so use data to your advantage and provide in-person and virtual experiences that resonate with your customers.

Not a Threat, an Opportunity

To stay at the leading edge of the banking world, community banks and smaller financial institutions must embrace technology and see digital banking as an opportunity as opposed to a threat. By adopting highly sought technology, these institutions can provide the convenience, personalization, and security their account holders have come to expect.

Sound like a tall order? SWBC makes it easier—and more affordable—to implement progressive technology that streamlines mortgage lending and home equity loan origination for both your loan officers and your account holders. Plus, a convenient, secure digital payment platform makes payments a snap, all under the protection of advanced encryption that safeguards sensitive member information. Now, you can provide multiple channels for account holders to repay their loans anytime, anywhere.

Ready to position yourself as a leader in modern banking? Visit our website to see how we can help you redefine the way your account holders bank.

Related Categories

Tyreo Harrison

As Executive Vice President, Lending & Insurance Solutions, Ty Harrison leads teams of lending and insurance professionals that are dedicated to delivering value-added programs, services and technology tailored to address the needs of lenders, loan servicers, portfolio managers, mortgage brokers, insurance agents and insurance brokers.

Let Us Know What You Thought about this Post.

Put your Comment Below.