For property owners across Bexar County, your property record plays a key role in determining your assessed value and your annual property taxes.

Soaring Home Prices and the Need for Excess Flood Insurance

Everyone is at risk of flooding, so it's important to understand how much risk your home could potentially face. Homeowners and buyers can find out if a property is at low, medium, or high risk on the Federal Emergency Management Agency (FEMA) site. So where do you fall on the Flood Zone Map and what kind of flood insurance coverage do you need for your home and belongings?

The map is divided into zones that are used to help determine policy rates. Although federal loans do not require flood insurance outside of FEMA's designated Special Flood Hazard Areas (A & V zones), it is recommended that flood coverage be obtained by all property owners. According to the Texas Floodplain Management Association, approximately

25% of all flood damages occur in low-risk zones, commonly described as being “outside the mapped flood zone.”

Other Flooding Risk

Just because you may not live in a high-risk zone doesn’t mean that you are completely safe from flood damage. Flooding can occur from poor drainage systems, storms, melting snow, neighborhood construction, and broken or damaged water lines.

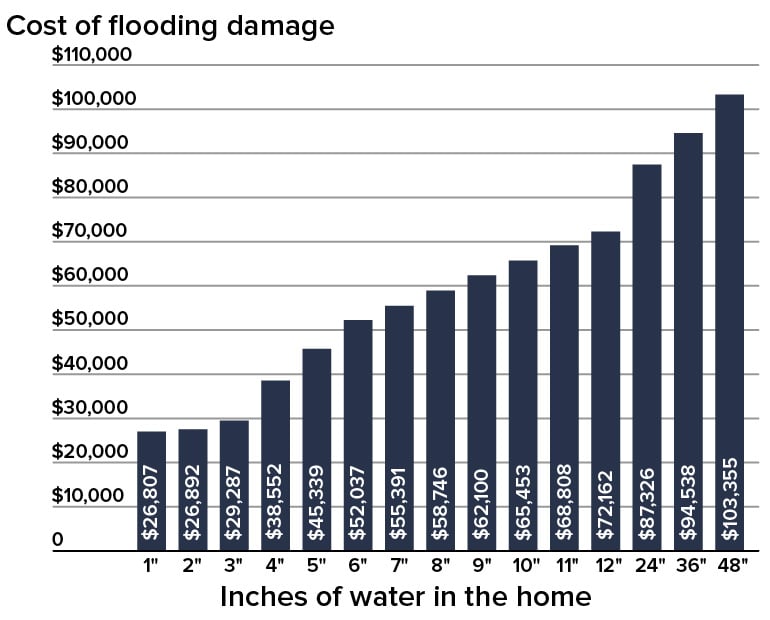

Flooding is among the most frequent and costly natural disasters. Even those who carry a flood policy on their home or business may be surprised to learn that sufficient funds to repair, rebuild, or replace contents may not be available with a standard flood insurance policy. Just one inch of water in a home can cause more than $27,000 in damage. Most homeowners have standard coverage through the government-funded National Flood Insurance Program (NFIP) from FEMA.

In recent years, more homeowners have opted to purchase coverage with private insurance entities due to the lack of policy options and are finding the coverage offered through NFIP is too low. Most standard flood insurance policies that protect properties located in areas participating in the NFIP typically only provide coverage up to $250,000 for residential property, with maximum content coverage of $100,000. Private flood insurance can offer a higher level of coverage for homes and belongings that exceeds standard plans offered through the government-funded program.

The Real Risk of Flooding

It’s wise to obtain flood coverage that is equal to or greater than the value of your home and personal belongings. Water damage costs—not including the contents of the home—are calculated based on the square footage of the structure, the amount of water, and the cost of labor to clean up.

*Chart above based on amount of water in a 2,500 sqft home.

According to Zillow, the typical value of U.S. homes is $337,560 as of March 2022. Given that most homeowners have watched the value of their homes skyrocket over the last couple of years, a standard flood policy may not provide enough coverage. Many homeowners should seriously consider excess flood coverage that provides coverage over the standard $250,000.

Coverage for Your Home

With zero production commitments, direct access to our dedicated flood underwriters, and market-leading revenue opportunities, SWBC is the clear premier flood coverage option. SWBC has the ability to offer private flood insurance-focused specifically on risks falling outside the NFIP-excess layers and primary coverage for properties located in CBRA and NPC zones. As property values continue to soar, excess coverage above and beyond the NFIP becomes more relevant than ever.

Let Us Know What You Thought about this Post.

Put your Comment Below.