For property owners across Bexar County, your property record plays a key role in determining your assessed value and your annual property taxes.

3 Benefits of Charitable Gifting Through a Donor-Advised Fund

The holidays are approaching, and we all know this time of year gets busy fast and flies by. In all the pumpkin-spice and peppermint bustle, you probably don’t have much time to spend reviewing all those charitable requests that come in this time of year—not to mention getting your tax documentation ready for 2022! Unfortunately, not reviewing these choices carefully could result in your charitable donations not going to a worthy cause, or—even worse—a blatant scam.

A donor-advised fund, or DAF, can help high-net-worth individuals manage their donations by establishing a charitable savings account. Money in this account is earmarked for charitable giving, but you don’t have to designate a specific recipient right away. The money is set aside and you can pull funds from it at any time throughout the year to send to a qualified charity of your choice. Meanwhile, the money in this account can grow tax-free, contributions made to a donor-advised fund may qualify for a charitable deduction that year.

If you’re considering donating to charity this year—thank you! Supporting the communities you care about by contributing to social causes is a wonderful way to add value to the lives of those around you. Charitable gifting through a donor-advised fund can make the process of giving as simple as it is rewarding. In this blog post, we’ll discuss the top benefits of managing your donations through a donor-advised fund.

The Basics of Charitable Gifting Using a Donor-Advised Fund

Eileen Price, President and CEO of the National Philanthropic Trust, on DAFs:

“Donor-advised funds are one type of charitable giving vehicle that enables donors to reach their philanthropic goals. DAFs are flexible giving tools. They serve many different philanthropic situations, whether facilitating workplace giving at a global corporation, multigenerational philanthropy in a single-family, or emergency responses to pressing needs in our own communities or beyond.

That is why the fastest growth rate of any metric we record is the number of individual DAF accounts. They have quadrupled in the last five years. It is clear that donors increasingly choose DAFs to facilitate their giving and that DAF donors are having an undeniable impact on charitable causes.”

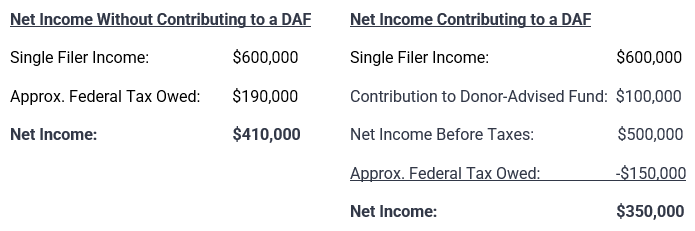

The biggest potential benefit to opening a donor-advised fund is the immediate potential tax deduction you get for the year you put money into the fund. Here is an example:

So, you make a $100k contribution to the fund, but your net income is only $60,000 less.

Given their growing popularity, there are now thousands of DAFs available throughout the country. Major fund companies, as well as community foundations, local charities, and universities seeking grants offer DAF accounts. There is typically a minimum requirement to invest, which can range from about $25,000-$50,000, and there is a small administrative fee associated with these accounts (typically less than 1%).

The Benefits of Leveraging a Donor-Advised Fund to Manage Charitable Donations

There are several benefits to using a donor-advised fund to manage your charitable donations, including:

Potential Tax Savings

If you opt-out of the standard deduction (for 2021, this is $12,500 for individuals and $25,100 for married couples filing jointly) and decide to itemize, you may qualify for a tax deduction for your charitable donations. For this option to make sense for you, your itemized deductions would need to be higher than the standard deductions, so you would need sizable itemized deductions.

According to Consumer Reports, “Even if you don’t itemize, a DAF may still be a good giving option if you have noncash assets—such as securities that aren’t publicly traded, or stocks—that have grown in value over time. Many smaller charities, such as homeless shelters and food pantries, might not have the resources to manage such donations. Contributing that appreciated asset to a DAF allows it to be sold and the money sent to charity with little or no hassle.”

Less Hassle and Simplified Record-Keeping

Donating money to support a cause you care about is a wonderful feeling. Filling out all the paperwork to make it happen? Not so much. A DAF account allows you to track your annual contributions and cuts down on paperwork by providing a single tax document for all the funds that were taken from the account throughout the year. Your wealth manager will also make sure that your contribution goes to a qualified charitable organization that is officially registered with the IRS as a 501(c)3.

With a donor-advised fund, a third party typically handles the administrative process of managing and distributing your contributions.

Growing Wealth for Good Causes

Your advisor can help you oversee and manage your donor-advised fund investments. Many DAFs also provide socially conscious investing options, which allow you to put your money in shares of companies that have environmentally sustainable policies or a positive social impact.

The simple truth is, managing finances is complicated. Making well-informed decisions about where and how to donate or invest your wealth works better when you have an expert financial advisor on your side.

Related Categories

Financial PlanningMark Travis

As Senior Financial Advisor for SWBC, Mark Travis has built long-term client relationships by providing comprehensive financial expertise, service, and oversight. Mark is well versed in helping clients solve complex and unique financial challenges, especially in his work with high-net-worth individuals, charitable entities, ERISA-covered defined benefit plans, and defined contribution plans. Mark holds the Chartered Retirement Planning Coordinator (CRPC®) designation; FINRA Series 7, 31, and 66 licenses; and Texas life and health insurance license.

Let Us Know What You Thought about this Post.

Put your Comment Below.