For property owners across Bexar County, your property record plays a key role in determining your assessed value and your annual property taxes.

Surprising Life Insurance Statistics Everyone Should Know

Life insurance should be a part of everyone's financial plan. Whether you are young and healthy or more seasoned with a family, life insurance offers peace of mind and protection for your loved ones. Although most people don’t like to think about it, getting life insurance is an important decision for you and your family. Buying life insurance now helps protect your dependents later if you’re not around to take care of them. After you’re gone, your family can use the proceeds to cover funeral costs, the mortgage and other loan payments, college tuition, plus additional miscellaneous expenses.

While most people realize that life insurance is an important element of their overall financial program, it’s also a complex product. Understanding the ins and outs of cost, types of policies, and which policy is best suited to your needs can be confusing. In this blog post, we’ll take a look at some life insurance statistics that may surprise you—and set the record straight.

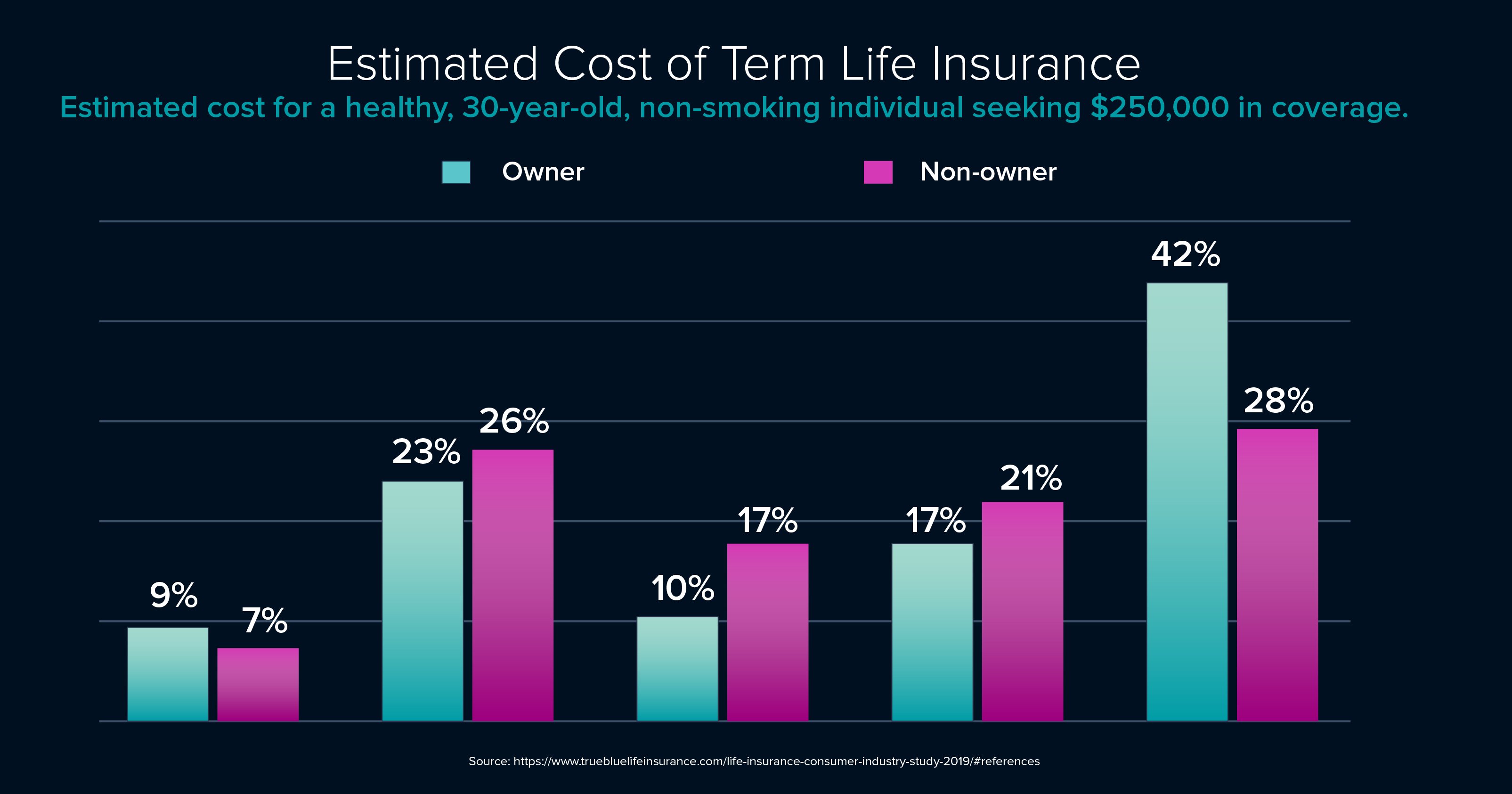

Cost of Term Life Insurance—Expectation vs. Reality

When asked how much they expected a $250,000 term life insurance policy would cost, the majority of respondents—both owners and non-owners of life insurance policies—guessed $500 a year or more! In reality, life insurance is much less expensive than many people think.

On average, a healthy, 30-year-old male can get a 20-year, $250,000 term life policy for approximately $160 a year, or about $13 a month. Many of our monthly discretionary expenses actually cost more than a standard term life policy for a healthy individual. At less than $15 per month, it’s easy to find expenses that can be trimmed or reallocated to a life insurance policy to provide your family with security.

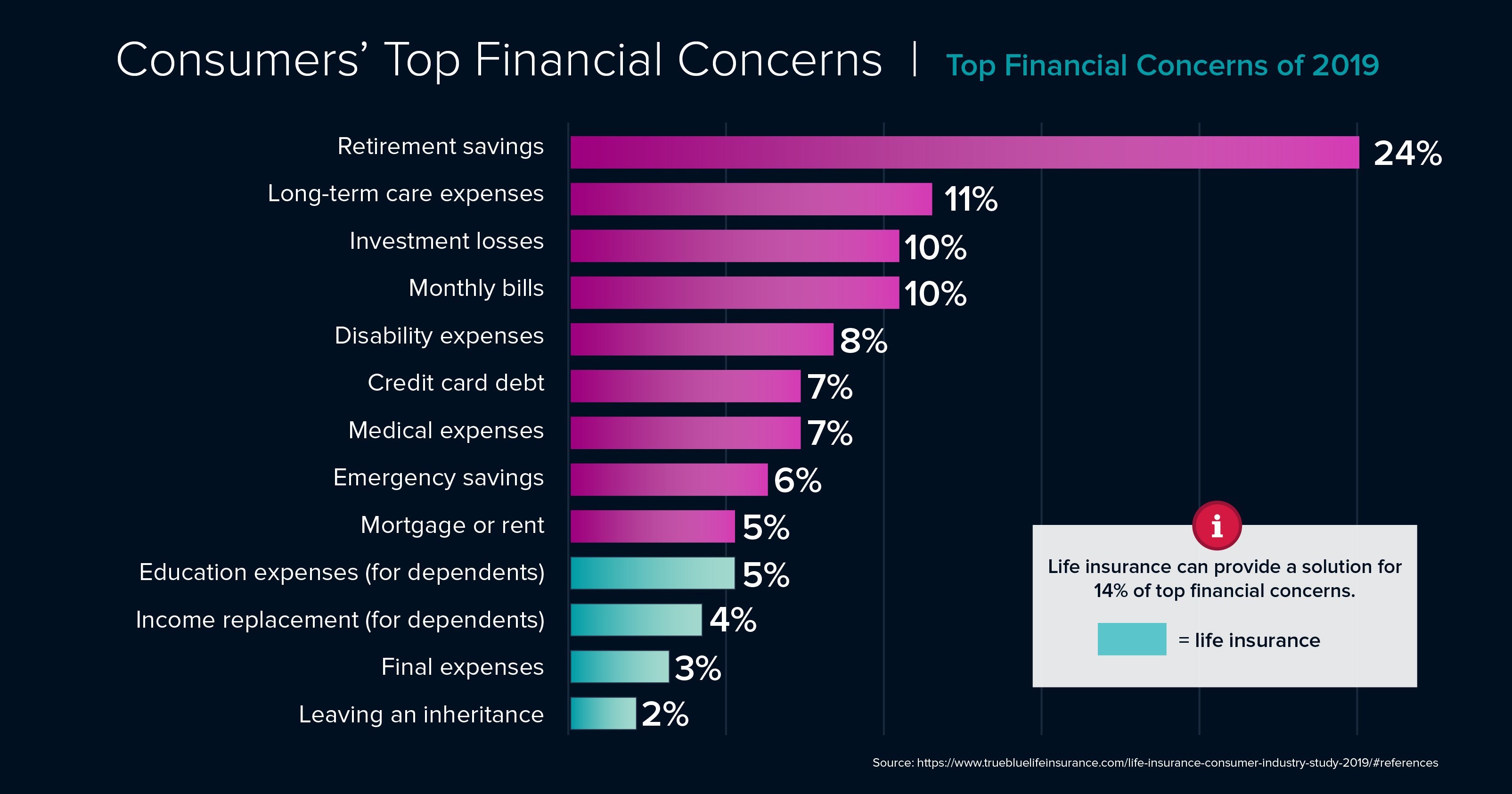

Consumers’ Top Financial Concerns

Although life insurance did not make the list of top-of-mind financial concerns for consumers, life insurance can provide a financial solution to 14% of Americans’ most critical concerns. In fact, some insurance policies are strategically used to generate cash value to use for additional purposes. For example, some permanent life insurance options allow a policy to build up cash value like a savings account that can be borrowed against, if necessary.

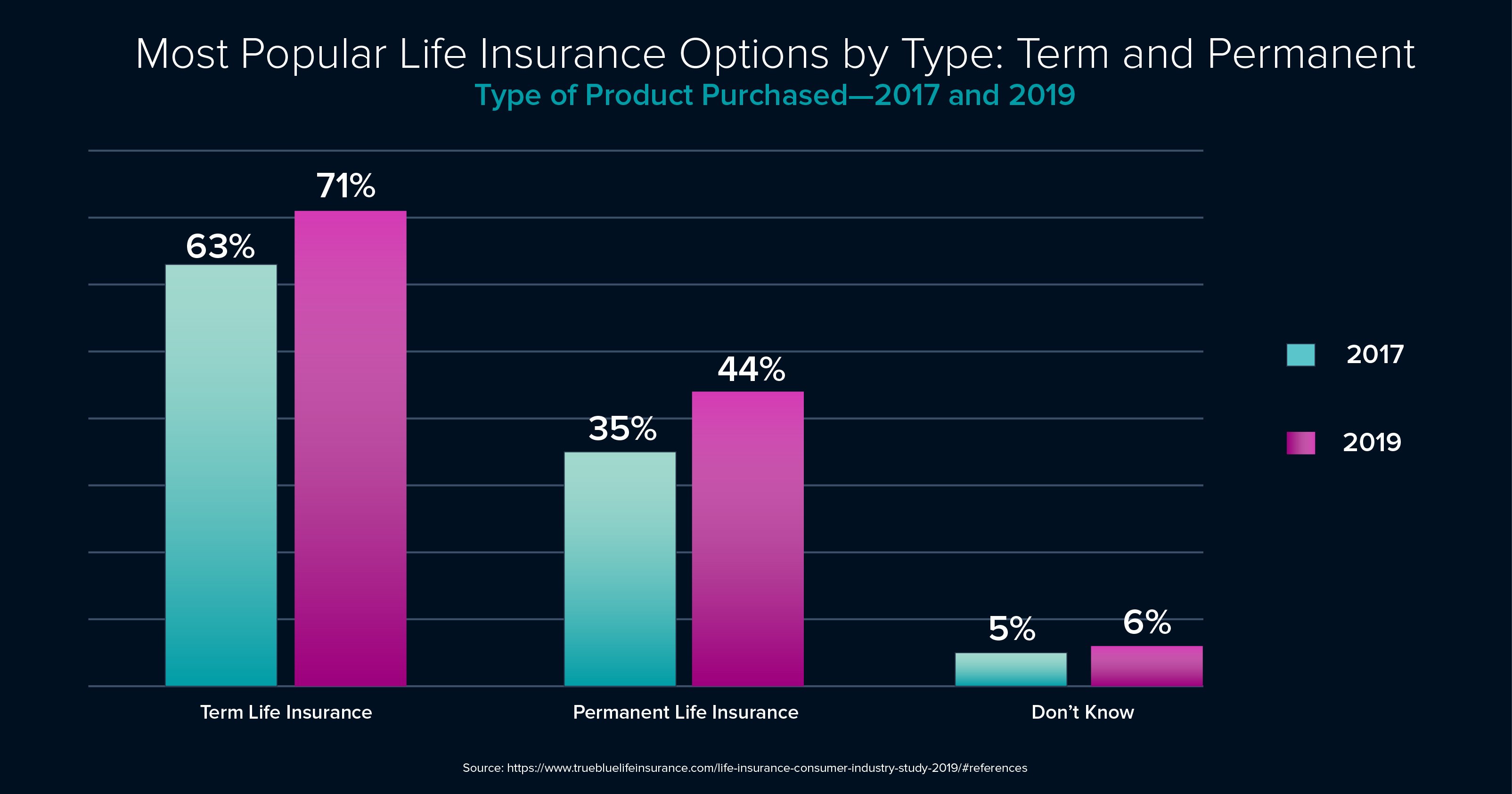

Most Popular Life Insurance Options by Type: Term and Permanent

If you're not sure what type of life insurance you should get—term life insurance or permanent life insurance—you’ll need to understand the difference between the two to make the best decision for you and your loved ones. Once that's clear, you can select the type that best suits your needs.

There are two main types of life insurance: term and permanent. Term life insurance is the easiest to understand and has the lowest cost. Permanent life is the most well-known and tends to be more expensive than term, but offers additional benefits—most importantly that it remains in force for your lifetime rather than just a set number of years.

Related Reading: The Differences Between Term Life and Permanent Life Insurance

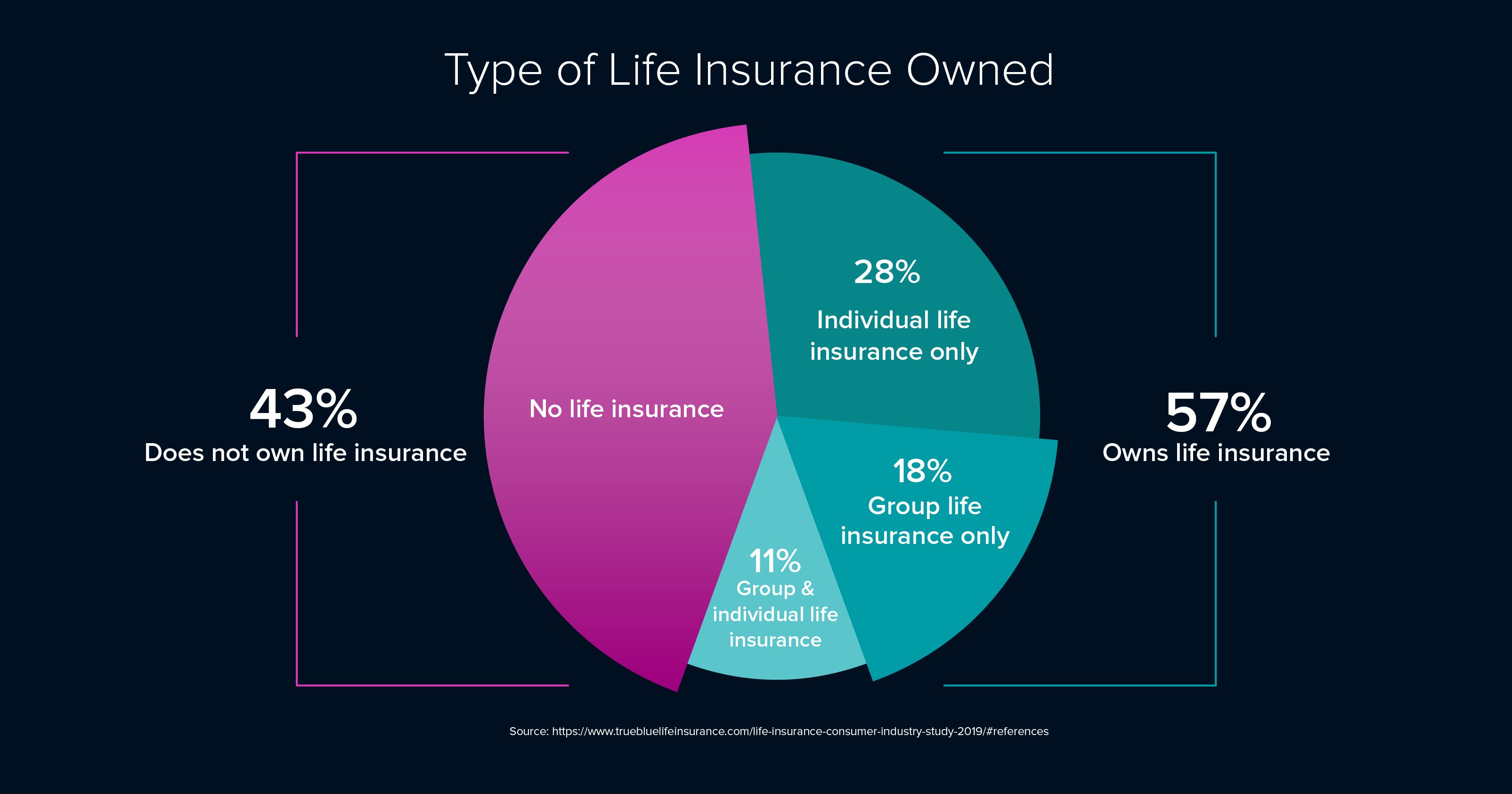

Type of Life Insurance Owned

There are a number of life insurance products out in the market, and you may be overwhelmed with the options available to you. More importantly, there may be a number of them that seem foreign to you. Just remember, while the intricacies of each life insurance product or policy may be different, the basic purpose of life insurance is all the same. Life insurance was designed to leave a lump sum of money behind when you die.

If you are confused about any or all of your options, remember that a life insurance agent can help assess your situation and needs and recommend what type or combination of life insurance options would be best for you. Remember—any life insurance coverage is better than none!

Joan Cleveland, CLU, ChFC, REBC

Joan Cleveland, CLU, ChFC, REBC is President and CEO of SWBC Life Insurance Company and SWBC Property and Casualty Insurance Company, with more than 35 years of experience in the life insurance industry. She holds her Agent license for Life and Accident & Health Insurance, along with multiple FINRA securities licenses. Joan is a frequent industry speaker and media spokesperson. She is a member of the Board of Directors of the Consumer Credit Insurance Association, Board Chair of the Life Insurers Council and an active member of the Texas Association of Life and Health Insurers.

Let Us Know What You Thought about this Post.

Put your Comment Below.