AI Volatility Deepens as Tech Selloff Drives Flight to Quality The sharp, AI-driven correction in equities continued last week as renewed volatility in the technology sector weighed on markets. Concer...

Market Commentary: Week of March 11, 2024

The market spent much of last week in a relatively stable but steadily decreasing interest rate pattern. The 10-year UST closed just below the previous support level of 4.19%, indicating a trend towards lower rates absent meaningful data. Chair Powell’s testimony before Congress supported this sentiment as his comments helped cool off the recent inflation concerns. Notably, he indicated that the Fed was closer to gaining confidence in its directive and reiterated the sentiment that rate cuts were likely this year. The release of the always-important jobs data on Friday suggested a solid, but slightly cooling labor market, which is helpful for the Fed to orchestrate a softer landing. However, most steam was removed from the market, leaving rates unchanged.

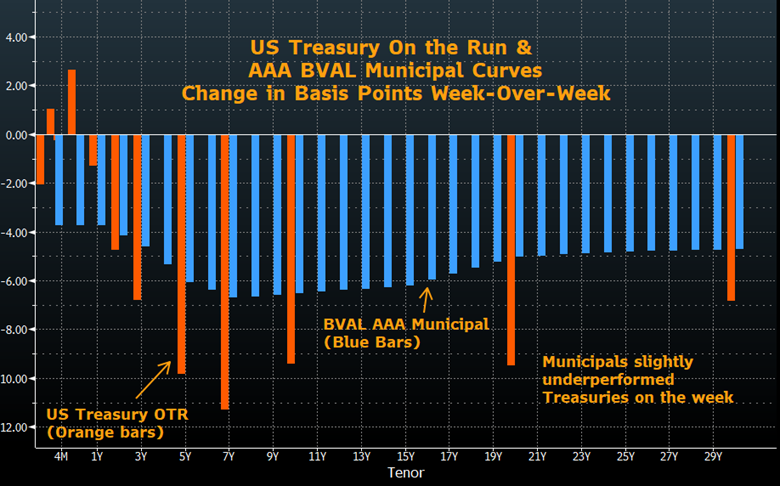

In municipals, buyers absorbed the slightly below average $5.7 billion new issue supply, with more significant marquis credits receiving heavy interest from buyers. The steady inflows into municipal funds supported the stable demand with nine consecutive weeks of positive flows. Contrarily, redemption monies are expected to be lighter, dropping from $36 billion in February to a modest $25 billion in March. Generally, dealer inventories rose modestly because of the slight downtick in demand. Furthermore, as Treasury rates trended lower, municipals naturally followed with rates declining by 5-7 basis points along the curve. Accordingly, ratios remained about the same but barely higher, to 60% in 10 years and 62% in 2 years. So, the relative value was modestly better, but left much room for improvement, which historically occurs as we head closer to April 15th tax time.

This week, $8.6 billion in new municipal deals are scheduled to be priced. It will be interesting to see if the market blinks (I’m not betting on it yet) and starts meaningfully cheapening, considering this supply, or if buyers continue seeking opportunities to put cash to work. I anticipate a slight price decrease as we move through March into April, but nothing that will significantly disturb the market. Rest assured that the market is stable, and any fluctuations are expected to be minor. SWBC experienced fluctuations in customer buying activity on Wednesday and Thursday afternoons last week as the market reacted to Chair Powell’s testimony. The commentary from last week indicated that customers are seeking more extended call structures with lower coupons. The desk was busy bidding on loans the previous week and appreciated client orders and feedback.

An index is unmanaged and not available for direct investment. Definitions sourced from Bloomberg.

The Bloomberg Barclays Global Aggregate Negative Yielding Debt Market Value Index represents the portion of the Bloomberg Barclays Global Aggregate Index that measures the aggregate value of global debt with a negative yield. • The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. • The NASDAQ Composite Index is a broad-based capitalization-weighted index of stocks in all three NASDAQ tiers: Global Select, Global Market and Capital Market. The index was developed with a base level of 100 as of February 5, 1971.• The Cboe Volatility Index® (VIX) is a calculation designed to produce a measure of constant, 30-day expected volatility of the US stock market, derived from real-time, mid-quote prices of weekly S&P 500® Index (SPX) call and put options with a range of 23 to 37 days to expiration.• The ICE BofA MOVE Index is a yield curve weighted index of the normalized implied volatility on 1-month Treasury options. It is the weighted average of implied volatilities on the CT2 (Current 2 Year Government Note), CT5 (Current 5 Year Government Note), CT10 (Current 10 Year Government Note), and CT30 (Current 30 Year Government Note), with weights 0.2/0.2/0.4/0.2 respectively.• The Markit CDX North America Investment Grade Index is composed of 125 equally weighted credit default swaps on investment grade entities, distributed among 6 sub-indices: High Volatility, Consumer, Energy, Financial, Industrial, and Technology, Media & Tele-communications. Markit CDX indices roll every 6 months in March & September. • The Markit CDX North America High Yield Index is composed of 100 non-investment grade entities, distributed among 2 sub-indices: B, BB. All entities are domiciled in North America. Markit CDX indices roll every 6 months in March & September. • The U.S. Dollar Index (USDX) indicates the general international value of the USD. The USDX does this by averaging the exchange rates between the USD and major world currencies. Intercontinental Exchange (ICE) US computes this by using the rates supplied by some 500 banks.

Investing involves certain risks, including possible loss of principal. You should understand and carefully consider a strategy’s objectives, risks, fees, expenses, and other information before investing. The views expressed in this commentary are subject to change and are not intended to be a recommendation or investment advice. Such views do not take into account the individual financial circumstances or objectives of any investor that receives them. All indices are unmanaged and are not available for direct investment. Indices do not incur costs including the payment of transaction costs, fees, and other expenses. This information should not be considered a solicitation or an offer to provide any service in any jurisdiction where it would be unlawful to do so under the laws of that jurisdiction. Past performance is no guarantee of future results.

© 2021 SWBC. All rights reserved. Securities offered through SWBC Investment Services, LLC, a registered broker/dealer. Member FINRA & SIPC. Advisory services offered through SWBC Investment Company, a Registered Investment Advisor, registered as such with the US Securities & Exchange Commission. SWBC Investment Services, LLC is under separate ownership from any other named entity. SWBC Investment Services, LLC a division of SWBC, is a nationwide partnership of advisor.

Related Categories

Capital MarketsChristopher Brigati, Chief Investment Officer — Managing Director

Prior to joining SWBC, Brigati was Senior Vice President, Managing Director of Municipal Investments at Valley National Bank. With over 25 years of experience primarily in the municipal market, he is a recognized thought leader in the fixed-income markets and is a regular contributor with appearances on Bloomberg Television and Radio. He has authored numerous economic commentaries and his insights have been featured in leading financial media publications, including The Bond Buyer, The Wall Street Journal, and Bloomberg. Brigati has also been an active participant with the Bond Dealers of America (BDA) trade association, advocating regulators and legislators on Capitol Hill on behalf of the broker-dealer community. Before joining Valley National Bank, he served as Managing Director and Head of Municipal Trading at Advisors Asset Management, Inc. (AAM). Before that, he had a long career at Morgan Stanley where he served as Managing Director and Head of Wealth Management Municipal Trading for eight years. Brigati holds a bachelor’s degree from The State University of New York at Albany School of Business. He is registered for Series 3, 4, 7, 24, 53, and 63.

Let Us Know What You Thought about this Post.

Put your Comment Below.