AI Volatility Deepens as Tech Selloff Drives Flight to Quality The sharp, AI-driven correction in equities continued last week as renewed volatility in the technology sector weighed on markets. Concer...

Market Commentary: Week of February 12, 2024

The calm between the storms?

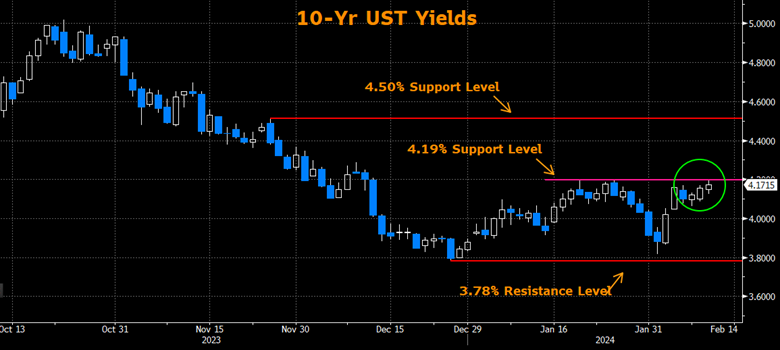

With a shortage of data and other significant market-influencing events last week compared to the week prior, the market settled into a relatively quiet trading pattern. Except for last Monday (February 5th), interest rates were in “normal-ish” trading ranges intra-day. Rates along the curve ended the week near the upper end of the recent range; in some cases, meaningfully testing support levels. Notably, 2-year UST pushed up close to 4.50%, 10-year UST tested 4.19%, and 30-year UST is approaching the 4.42% January high. Technical factors indicate that yields breaking above these support levels could lead to higher rates in the near term. Such an opportunity would give investors a buying opportunity to lock in even more attractive levels in the market.

Source: Bloomberg

SWBC client activity was tactical in its approach throughout much of last week. The front end of the curve and the 13-20-year maturity range saw the most engagement. Given the current shape of the municipal yield curve, it is no surprise that the 4-12-year maturity range lacks attraction for buyers. Though last week’s new issue supply was a respectable (if not large) $7.7bln, the year-to-date volume has been constrained. This fact, coupled with stingier bid-wanted list activity, pressured the bid side of the market to remain tight. The client focuses on new issues that created strong over-subscriptions with arguably better yields than were available in the secondary market. If accounts could purchase paper at a yield-bogey upon which they were focused, trades were getting done. Furthermore, dealers generally seemed less willing to cut offers and execute at price concessions, given the difficulties in replacing inventory.

Looking ahead, I reiterate that higher yields should give investors a good buying opportunity in the long run. With the continued expectation from the market that the Fed is moving closer to cutting interest rates at some point in 2024, any pop-in rates should not be easily dismissed by seekers of value. Many SWBC clients indicate that cash on the sidelines is ample; they are just looking for a home in the markets at the right opportunity. Don’t wait too long or dismiss a “bird in the hand.”

Definitions:

An index is unmanaged and not available for direct investment. Definitions sourced from Bloomberg.

The Bloomberg Barclays Global Aggregate Negative Yielding Debt Market Value Index represents the portion of the Bloomberg Barclays Global Aggregate Index that measures the aggregate value of global debt with a negative yield. • The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. • The NASDAQ Composite Index is a broad-based capitalization-weighted index of stocks in all three NASDAQ tiers: Global Select, Global Market and Capital Market. The index was developed with a base level of 100 as of February 5, 1971.• The Cboe Volatility Index® (VIX) is a calculation designed to produce a measure of constant, 30-day expected volatility of the US stock market, derived from real-time, mid-quote prices of weekly S&P 500® Index (SPX) call and put options with a range of 23 to 37 days to expiration.• The ICE BofA MOVE Index is a yield curve weighted index of the normalized implied volatility on 1-month Treasury options. It is the weighted average of implied volatilities on the CT2 (Current 2 Year Government Note), CT5 (Current 5 Year Government Note), CT10 (Current 10 Year Government Note), and CT30 (Current 30 Year Government Note), with weights 0.2/0.2/0.4/0.2 respectively.• The Markit CDX North America Investment Grade Index is composed of 125 equally weighted credit default swaps on investment grade entities, distributed among 6 sub-indices: High Volatility, Consumer, Energy, Financial, Industrial, and Technology, Media & Tele-communications. Markit CDX indices roll every 6 months in March & September. • The Markit CDX North America High Yield Index is composed of 100 non-investment grade entities, distributed among 2 sub-indices: B, BB. All entities are domiciled in North America. Markit CDX indices roll every 6 months in March & September. • The U.S. Dollar Index (USDX) indicates the general international value of the USD. The USDX does this by averaging the exchange rates between the USD and major world currencies. Intercontinental Exchange (ICE) US computes this by using the rates supplied by some 500 banks.

Investing involves certain risks, including possible loss of principal. You should understand and carefully consider a strategy’s objectives, risks, fees, expenses, and other information before investing. The views expressed in this commentary are subject to change and are not intended to be a recommendation or investment advice. Such views do not take into account the individual financial circumstances or objectives of any investor that receives them. All indices are unmanaged and are not available for direct investment. Indices do not incur costs including the payment of transaction costs, fees, and other expenses. This information should not be considered a solicitation or an offer to provide any service in any jurisdiction where it would be unlawful to do so under the laws of that jurisdiction. Past performance is no guarantee of future results.

© 2021 SWBC. All rights reserved. Securities offered through SWBC Investment Services, LLC, a registered broker/dealer. Member FINRA & SIPC. Advisory services offered through SWBC Investment Company, a Registered Investment Advisor, registered as such with the US Securities & Exchange Commission. SWBC Investment Services, LLC is under separate ownership from any other named entity. SWBC Investment Services, LLC a division of SWBC, is a nationwide partnership of advisor.

Related Categories

Capital MarketsChristopher Brigati, Chief Investment Officer — Managing Director

Prior to joining SWBC, Brigati was Senior Vice President, Managing Director of Municipal Investments at Valley National Bank. With over 25 years of experience primarily in the municipal market, he is a recognized thought leader in the fixed-income markets and is a regular contributor with appearances on Bloomberg Television and Radio. He has authored numerous economic commentaries and his insights have been featured in leading financial media publications, including The Bond Buyer, The Wall Street Journal, and Bloomberg. Brigati has also been an active participant with the Bond Dealers of America (BDA) trade association, advocating regulators and legislators on Capitol Hill on behalf of the broker-dealer community. Before joining Valley National Bank, he served as Managing Director and Head of Municipal Trading at Advisors Asset Management, Inc. (AAM). Before that, he had a long career at Morgan Stanley where he served as Managing Director and Head of Wealth Management Municipal Trading for eight years. Brigati holds a bachelor’s degree from The State University of New York at Albany School of Business. He is registered for Series 3, 4, 7, 24, 53, and 63.

Let Us Know What You Thought about this Post.

Put your Comment Below.