Housing, Inflation, and Geopolitics: A Week That Reframed Market Expectations I had the distinct pleasure of speaking at the 2026 Texas Mortgage Bankers Association Conference in Houston last week. Un...

Market Commentary: Week of April 15, 2024

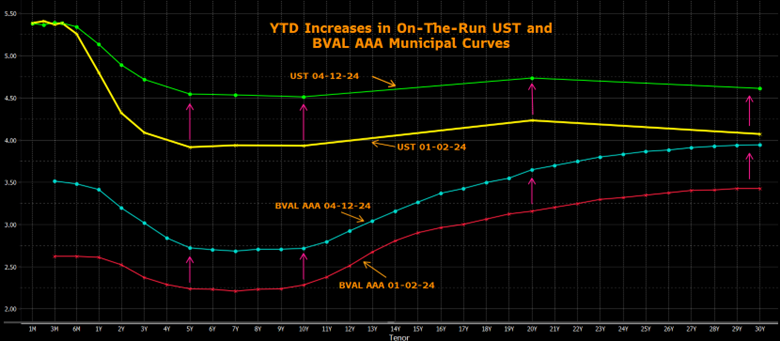

Volatility was last week’s “Word of the Week.” Nonfarm payroll data, released during the previous Friday's trading session, served as a catalyst for rates to initially gap higher. After rates pushed above major resistance levels during the prior week, rates continued to advance aggressively higher with a greater than 200% above average price change on Wednesday. Concerns about inflation and expectations for rate cuts by the Fed changed sharply following the third monthly data release, suggesting inflation remains a concern. Specifically, the 3-month annualized CPI came in at +4.6%, suggesting stickier inflation than the market's pricing. By Friday’s close, the market retraced about one-third of the sell-off, with geopolitical concerns taking center stage as conflict in the Middle East created a flight to quality bid in the markets.

The municipal market generally followed the Treasuries' lead as rates increased during the week. Though more muted in comparison (which isn’t saying much), today’s pending tax payment obligations caused some investors to be less engaged as their attention was focused away from markets. A larger, new issue calendar and mutual fund inflows–slightly unusual occurrences just before the aforementioned tax deadline, did not appear to provide additional fuel to higher rates in the municipal market.

As suggested above, SWBC clients were less engaged this past week. However, activity appears to remain concentrated in both the front end of the curve and further between 15-20 years. Conflicting themes of more attractive absolute yields continue to be countered by less attractive relative value opportunities, with ratios hovering below percentages that would entice buyers en masse. Every meaningful move higher in yield evokes more conversation about the abundance of cash on the sidelines eventually being put to work. Some suggestions have arisen that if 10-year Treasuries flirt with the 5% level touched back in October, the market presents a compelling buying opportunity that should not be missed. The above chart highlights the steepness of the municipal curve as compared to the flatter Treasury curve in longer-dated maturities. Additionally, it adds perspective regarding the sharp increases in yields from the beginning of the year. Based upon expectations in January for up to 7 rate cuts, nobody would have bet on interest rates shifting significantly higher in 2024. Therefore, as interest rates trend higher, investors should not dismiss the near-term opportunity to engage in duration-extension trades.

Related Categories

Capital MarketsChristopher Brigati, Chief Investment Officer — Managing Director

Prior to joining SWBC, Brigati was Senior Vice President, Managing Director of Municipal Investments at Valley National Bank. With over 25 years of experience primarily in the municipal market, he is a recognized thought leader in the fixed-income markets and is a regular contributor with appearances on Bloomberg Television and Radio. He has authored numerous economic commentaries and his insights have been featured in leading financial media publications, including The Bond Buyer, The Wall Street Journal, and Bloomberg. Brigati has also been an active participant with the Bond Dealers of America (BDA) trade association, advocating regulators and legislators on Capitol Hill on behalf of the broker-dealer community. Before joining Valley National Bank, he served as Managing Director and Head of Municipal Trading at Advisors Asset Management, Inc. (AAM). Before that, he had a long career at Morgan Stanley where he served as Managing Director and Head of Wealth Management Municipal Trading for eight years. Brigati holds a bachelor’s degree from The State University of New York at Albany School of Business. He is registered for Series 3, 4, 7, 24, 53, and 63.

Let Us Know What You Thought about this Post.

Put your Comment Below.